If you’re looking to save for retirement, you may have heard of a Roth 401(k). It’s a retirement savings account that works similarly to a traditional 401(k) but with a few important differences. In this article, we’ll dive into the details of what a Roth 401(k) is, how it works, and provide you with some tips to make the most of it.

What is a Roth 401(k)?

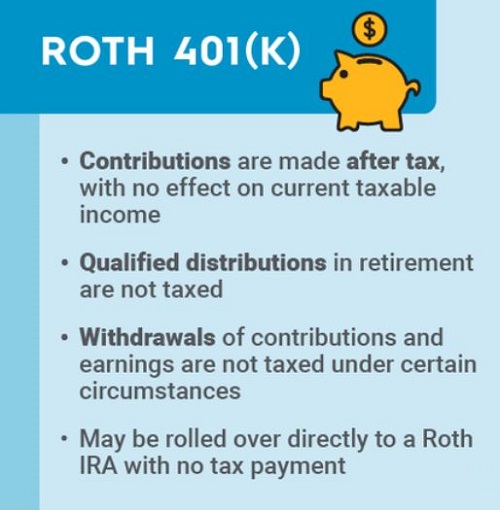

A Roth 401(k) is a type of retirement savings account that combines features of a traditional 401(k) and a Roth IRA. It allows you to contribute a portion of your after-tax income to a retirement account, and the money in your account grows tax-free.

This means that you won’t have to pay taxes on your investment gains, and you won’t have to pay taxes when you withdraw the money in retirement, as long as you meet certain requirements. The Roth 401(k) is a powerful tool for retirement savings and can help you build a solid foundation for your future.

How Does a Roth 401(k) Work?

With a Roth 401(k), you can contribute up to $19,500 (as of 2021) per year, or up to $26,000 if you’re age 50 or older. Your employer may also choose to match your contributions up to a certain amount. Once your money is in the account, it can be invested in a range of options, such as stocks, bonds, and mutual funds.

The money in your Roth 401(k) grows tax-free, which means you won’t have to pay taxes on any investment gains. Additionally, you won’t have to pay taxes when you withdraw the money in retirement, as long as you meet certain requirements. These requirements include being at least 59 ½ years old, having the account for at least five years, or meeting certain other qualifying events.

Tips for Maximizing Your Roth 401(k)

Here are some tips to help you make the most of your Roth 401(k) account:

Start contributing early

The earlier you begin contributing to your Roth 401(k), the more time your investments will have to grow. Time is one of the most significant advantages of saving for retirement, and starting early can help you maximize that advantage.

Contribute as much as possible

Try to contribute the maximum amount allowed to your Roth 401(k) every year to take full advantage of the tax-free growth and withdrawals. If you’re 50 or older, you can contribute even more each year.

Diversify your investments

Consider diversifying your investments by investing in a mix of stocks, bonds, and mutual funds. Diversification helps you spread out risk and increase your chances of earning higher returns.

Rebalance your portfolio regularly

Over time, your investment mix may become unbalanced. Be sure to rebalance your portfolio regularly to ensure your investments align with your goals.

Consider Roth conversions

If you have a traditional 401(k) or IRA, consider converting it to a Roth account to take advantage of tax-free growth and withdrawals. Roth conversions can be a powerful way to supercharge your retirement savings.

Conclusion

In conclusion, a Roth 401(k) is a powerful tool for retirement savings. It allows you to contribute after-tax dollars, grow your investments tax-free, and make tax-free withdrawals in retirement. By following these tips, you can make the most of your Roth 401(k) and build a solid foundation for your retirement.